The finest budgeting apps are a must-have for cost-conscious customers. Not as it were can they assist you spare cash and get distant better; a much better; a higher; a more reliable; an improved a distant better handle on your accounts, these helpful instruments can assist you to keep track of where each dollar is going, so you know where there’s room to spare and cut back on costs each month.

On the off chance that you would like to offer assistance in your investing and getting your accounts beneath control, a budgeting app may be fair what you wish. There are numerous budgeting apps to select from, each battling to recognize itself from the others.

Many applications are outlined for common individual budgeting, but each has something unique to offer. One app specializes in individual budgeting devices, whereas another offers charge tracking. One is dedicated to advertising the capacity to dole out each dollar you’ve got work, making a total cash administration framework. Another offers notices once you are near to overspending.

We’ve adjusted up the eight best budget apps to undertake if you need to ace your budget in 2020.

The best budgeting apps for Android & iOS

1. Mint

Mint is a prevalent free online individual back application from Intuit that gives an assortment of easy-to-use money related arranging and following tools. It is one of the most seasoned and best-known budgeting apps.

Claimed by Intuit, the same company that produces Quickbooks and TurboTax, Mint offers a cluster of highlights to assist you in tracking and oversee your cash from a mammoth list of banks, credit card backers, brokerages, loan specialists, and other budgetary institutions. It is one of the best budgeting apps.

Mint’s clients appreciate the taking after highlights:

- Flexible budgeting apparatuses permit for testing with diverse scenarios

- Ease of use

- Sends money related outlines and cautions by means of email or content message

- Tax devices coordinated with TurboTax

- Free credit score, fueled by Equifax

- Email or content alarms for unordinary account movement, charge updates, and moo balances

- Bank-level information security for account aggregation

- Easily customizable, edible money related reports

- Creation of investing and pay categories on the fly

- Automatic downloads of exchanges from nearly any budgetary institution within the U.S.

- Automatic categorization of downloaded transactions

- Systems alarms let you know on the off chance that account upgrades are slowed down for any reason

- Add the esteem of homes, cars, or other physical resources for exact net worth

- Easy-to-find offer assistance and support

The Mint program has the taking after downsides as well:

- Does not bolster different currencies

- No account compromise available

- No running account equalizations in account registers

- Can’t allot numerous investment funds objectives to one account

2. YNAB(You Need a Budget)

You need a Budget (YNAB for brief) that could be a great budget app if you lean toward a zero-based budget strategy. You Would like a Budget that can assist you in overseeing obligations, pay down credit cards, set reserve funds objectives, and more by making a framework of responsibility and empowering you to legitimize each cost.

It can help you cut costs and put more cash absent for a stormy day, effortlessly offsetting the month to month and yearly expenses it comes with after a free 34-day trial. Empowering clients to put each dollar to work more successfully, YNAB serves as a particularly valuable apparatus for anybody looking to construct a budgetary arrangement and more successfully address their month to month living costs. It is, additionally, the best budgeting app.

Pros

- Proven Method: YNAB’s Four Rules are the key, the enchantment, the mystery sauce, on the off chance that you’ll.

- Budget Together: Get to real-time data, from any gadget, anytime, makes it drop-dead straightforward to share accounts with an accomplice

- Goal Tracking: It’s approximately setting and coming to your objectives.

- Reports: Eye sweet, make it fun to fixate over your advance.

- Personal Support: Shoot them an email.

- Secure Data

- YNAB will really educate you on how to budget exceptionally viably as you employ it.

Cons

- YNAB does not do programmed exchange downloads.

- If you would like highlights like a venture back, monetary organizers for college, retirement or other life occasions, or advanced debt decrease arranging apparatuses, you’ll have to consider different software.

- It can be moderate to stack once you begin to begin it up and when moving between the Budget, Reports and Accounts segments of the program.

3. PocketGuard

Advertising a straightforward way to track investing and remain on the best of your funds, PocketGuard uncovers how much cash you’ve got accessible after paying your bills. Utilizing the app, you’ll rapidly see what kind of save cash you’re playing with each day, week, or month, and can put toward eating, excitement, dress, and other common costs.

Utilizing it, you’ll ease up on investing, discover ways to save, and know when you’ve got additional cash in your stash, so you’ll be able to hit the motion pictures or feast out. PocketGuard is outlined for individuals who need a streamlined way to track investing, make a budget, and oversee their accounts.

PocketGuard highlights are

- Make your claim categories.

- Change the date of transactions.

- Export exchange data.

- Create as numerous Objectives as you wish.

- Choose the “Fair once” alternative for repeating bills and incomes.

- Track cash merely spends and receives. Manage ATM stores and withdrawals.

PocketGuard drawbacks are

- Doesn’t incorporate monetary objectives.

- Advise is as well simplistic.

- Not great for anybody with a complicated budgetary situation.

- Lacks the capacity to include cash transactions.

- No focused on a month to month sparing goal.

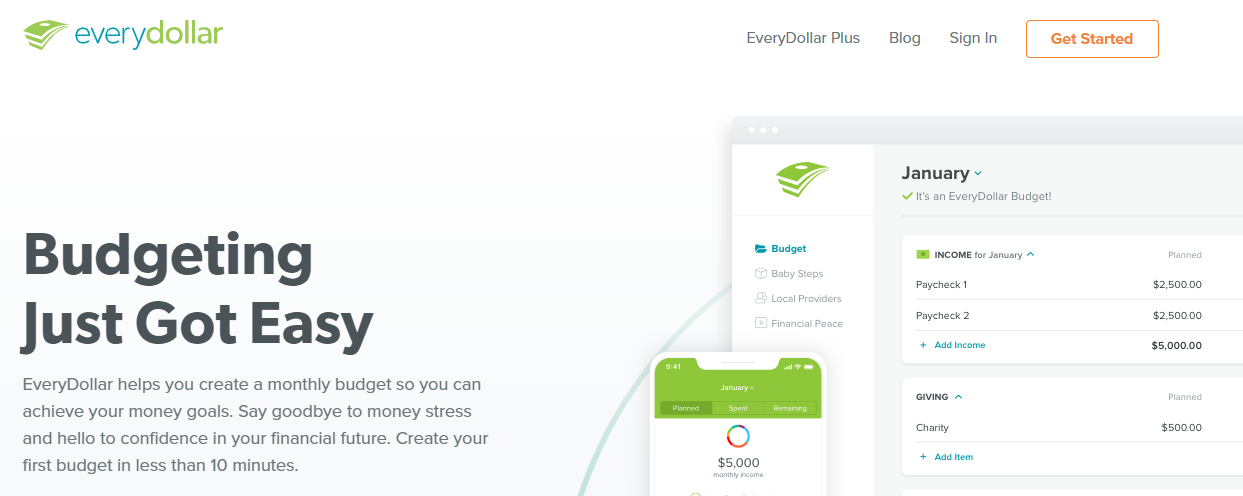

4. EveryDollar

Next in the list of best budgeting apps is EveryDollar. Outlined to assist clients in taking back control of their month to month budget, EveryDollar makes it simple to track exchanges, pick up more profound knowledge into normal costs, and arrange for massive purchases.

Install it, and you’ll be able quickly to see where each dollar is going, get a sense where you will be overspending, and discover better ways to create your cash work for you. Online syncing between gadgets implies you’ll overhaul anytime from computer or phone, and promptly make a budget that works for you.

EveryDollar highlights are

- Simple to Use

- Budgeting Only

- Dave Ramsey Approach to Debt

- Additional Help

- Ad-Free Service

- Multi-Transaction Drop. Possibly you’re an eager saver.

- Split Exchanges. Say you go to the basic supply store and choose up a few new vegetables, a cleanser bottle, and a blessing card to donate your colleague for her birthday.

- Debt Decrease Device.

- Bank Syncing.

EveryDollar drawbacks are

- As it were iOS empowered: Shockingly, the EveryDollar budgeting app is as it was accessible for iPhone clients within the AppStore. Even though it isn’t available for Android clients at this time, you’ll still be able to utilize the program on your computer.

- Can as it was adjusted to bank accounts if you pay: another drawback of EveryDollar’s free adaptation is that it can’t be associated with your bank account to consequently drag in your exchanges each night as they hit your account.

- Takes for a short time to adjust

- Incorrectly named exchanges

- Constrained Free Version

- Paid Benefit Not Cheap

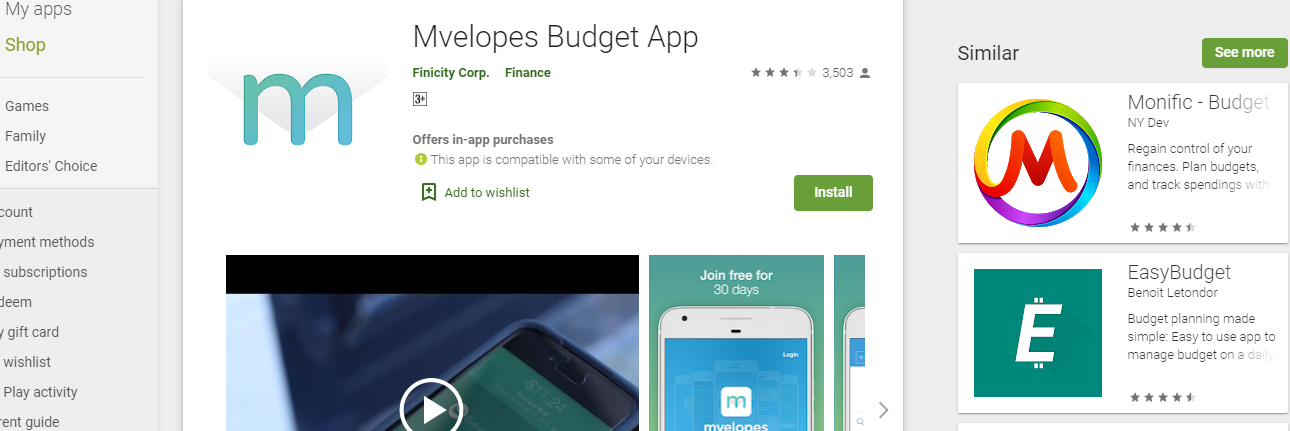

5. Mvelopes

Mvelopes is a strong individual fund computer program that syncs together with your budgetary teaching. It can assist you in making and oversee budgets, but it doesn’t bolster brokerage accounts. Cash budgeting loans itself well to envelope budgeting, a fashion of budgeting where you put cash in envelopes for distinctive investing categories.

When each envelope is purged, your budget for that category is all gone through for the month. Typically a bit more challenging with credit and charge cards, but Mvelopes makes it simple to take after cash fashion budgets in an advanced budgeting world.

Mvelopes highlights are

- Imports and categorizes bank transactions

- Uses a basic and successful envelope budgeting method.

- Generates a cluster of individual monetary reports

- 60 Days Free.

- Unlimited Envelopes and Money related Institution Accounts. Auto Exchange Bringing in and Account Adjust Monitoring. Live Chat & Information Base.

- Interactive Reports.

- Access to the Mvelopes Learning Center.

- Debt Decrease Center.

- Initial Setup Help.

Mvelopes drawbacks are

- The interface is dated and can be baffling to learn.

- Doesn’t bolster brokerage accounts.

- There’s no free form. The essential arrangement is the cheapest one accessible at $4 per month.

- It’s not as comprehensive as a few other monetary administrations since you can’t utilize it for bill installment or speculation observing.

- There may be a reasonable sum of work included with this framework since you’ll get to enter a part of the information physically.

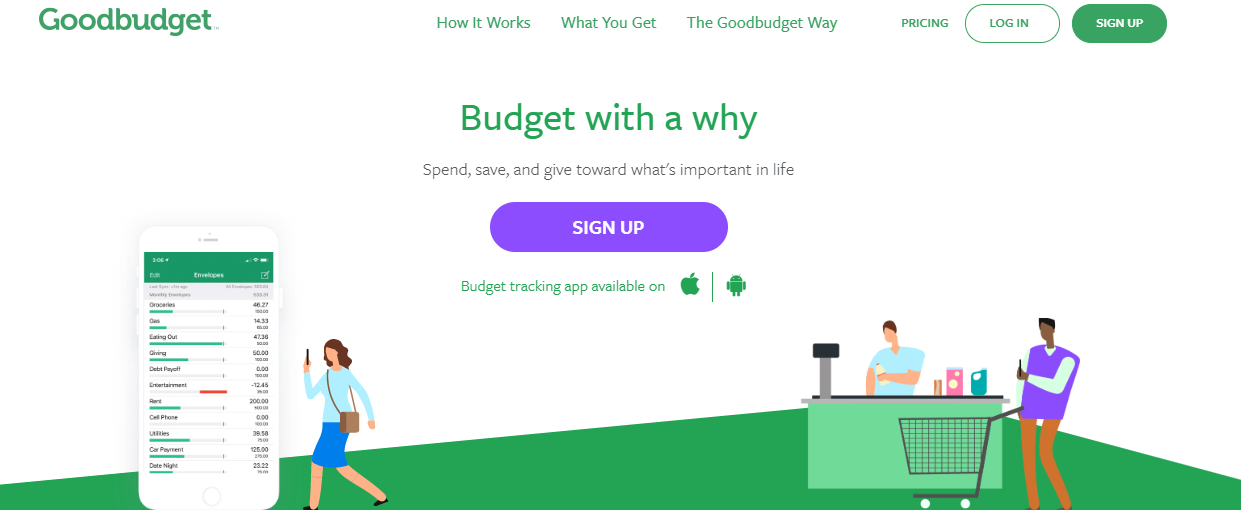

6. Goodbudget

Once known as Simple Envelope Budget Help or EEBA, Goodbudget may be a culminate choice for couples who need to share their budgeting handle. Goodbudget is another best budget app that utilizes the envelope strategy to help you track your costs each month.

The app can adjust with bank and credit card accounts over different gadgets, which makes it a great choice for couples attempting to remain on the beat of their family budget as a group.

Goodbudget highlights are

- Multi-Currency

- Alerts

- Reports

- Bills Management

- Budgeting

- Spend Tracker

- Tax Reports

- Transaction History

- Budgeting that works. Based on the envelope budgeting strategy – a time-tested framework that works!

- Sync & share budgets. Put your budget into activity with the individuals who matter most.

- Save for enormous costs. Arrange ahead and be arranged.

- Pay off debt.

Goodbudget drawbacks are

- There’s no way to put through to your accounts with money related teach; any exchanged data needs to be entered or imported. Bulk bringing in makes the errand much less demanding, but it’s still a burden on the off chance that you need something that does everything for you.

- Goodbudget does not sync with your money related to education, to cash moves in and out of your different bank accounts, you have to physically enter the exchanges.

- The free form isn’t a reasonable choice for everybody. A few clients discover it doesn’t incorporate sufficient envelopes and disdain that it confines them to one monetary account.

- Another eminent drawback is that you just can’t control everything from the app, in any case of the plan you select.

7. Money Lover

Money lover is a recent launch but has made its way into the editor’s choice of PlayStore. It’s a simple app with easy-to-use interference. What makes it one of the best budgeting apps in 2020 is the features which it offers.

Features:

- Easy to use interface

- Budgeting system available

- Various options like goal setting, recurring transaction, etc. Available

- Connect to the bank option.

- Login made easy through various modes.

Pros

- Budgeting is made simple.

- Photo transaction available Premium)

- Consumer supports available

- Goals option available which is useful for savings

Cons

- Advertisements are frequent.

- Fewer options for banks to be connected

- Free versions lack few features

Link: https://play.google.com/store/apps/details?id=com.bookmark.money

8. Monefy

Money can be your choice of best budgeting app if you prefer uploading your data manually. It’s a budgeting app allowing you to upload the data and is quite easy to use manually. It has made its way into the editor’s choice apps of the Play store too.

Features:

- Dropbox and Google Sync (Premium)

- User-friendly and simple interface.

- CSV data exporting.

- Manual Data Input.

- Supports all types of currencies

- Passcode security available

- Budgeting option available

Pros

- Quite less amount of advertisement in the free version.

- Passcode security

- Simple to use

- Easy navigation through all the entries

Cons

- No availability of guidelines.

- Webpage login absent

- Only numeric passcodes supported

- iPhone version is less efficient

- Manual input only which can cause user discomfort

Link: https://play.google.com/store/apps/details?id=com.monefy.app.lite

It’s the budget that matters for a good lifestyle. The Best Budgeting Apps in 2020 were listed above

Summing Up

So, these are the best budgeting apps in 2020. Most of these are apps are free and available for both, Android & iOS devices. You can start by trying one of them or replace the existing ones based on the features that these apps provide.