Investing has been considered an agony until the past few years. No more waiting with your fingers crossed for the arrival of your quarterly report. Today, the contemporary world gives you the best investment apps at a click of a button on your screen.

Since both fintech startups & traditional brokerages provide investing apps, the chances of you finding one that fits your needs is very plausible. These apps, along with their pros & cons, should help you get a better idea of which app suits you best.

Related – 6 Best Free & Paid QuickBooks Alternatives For Small Businesses.

Best Investment Apps in 2020

1. Acorns

Acorns have been the “old guy” in the breed of new investment apps, but it’s not obsolete. It yet remains one of the more famous investment apps amongst the “new boys” mainly because of how easy it is to use. The need to pay attention to the app is almost zero once you’ve set it up. Once you link your debit or credit card, Acorns will round up the total on purchases to the next dollar and invest the difference into one of the few EFT portfolios.

It only costs $1 per month for Acorns Invest, which is a steal. Although the company does offer other features if you’re willing to step up a dollar. Bundled with Acorns Invest, you then get Acorns Later.

Acorns Later, choose your portfolio based on the targeted time until your retirement (calculated as age 59 ½), becoming more conservative as you near that age. And for an additional $1 per month, you can add Acorns Spend, which provides an FDIC-protected checking account with a debit card, among other things.

Pros:

- You don’t need a minimum investment amount to open an account.

- Plenty of options for customization.

- You can create an IRA using your spare change available.

Cons:

- The cost can be high if you keep a low balance.

- There are no tax benefits. Acorn does not offer any type of tax assistance.

Related – 11 Best Instant Messaging Apps For iOS.

2. Robinhood

Robinhood is the go-to app if you don’t want to come across trade commissions. This app allows you to trade stocks, ETFs, and cryptocurrency for free. It is great for investors who want to cut down on costs. The app provides a smooth and stripped-down user interface, which is simple to navigate across. However, the app does not provide any investment guidance to the investor.

The app provides a feed that aggregates stories from news and investing sites so that you are always informed. After you’ve decided what you want to trade and enter the number of shares to buy or sell, swipe up, and the order is on its way. Another great feature of the app is instant delivery of the first $1,000 of any funds you deposit to the account, so you can start trading immediately.

Pros:

- User-friendly app. Robinhood’s target audiences are those who want a slick experience, and it does it perfectly.

- No minimum balance required. Robinhood does not have a minimum balance requirement allowing the investor to get started right away.

- Robinhood has introduced fractional shares, which means that you can pay as little as $1 for a part of a share even if that share costs more.

Cons:

- Robinhood has limited securities. It does not support mutual funds and mutual bonds. The app does not have an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them.

- Its poor customer support. Many investors expect good customer support, i.e., over the phone support, but it is not available here. It is done via e-mails.

3. Betterment

Betterment of the investment app that has been going on since 2008. It was the first public Robo-advisor, which allows users to create a custom portfolio for the user based on a starter survey. The focus of Betterment is to save its investors more on taxes than other services.

Betterment, like its competitors, automatically conducts tax-loss harvesting on all the accounts of a user. However, unlike its competitors, it takes one step further with its asset location strategy, in which it helps clients with both taxable and retirement accounts.

Betterment has no minimum so that a user can start with as small an investment as they’d like to, and it only charges a 0.25% account management fee, which is relatively cheap. The consumers of the app are given a choice between a premium portfolio, in which consumers can receive guidance from certified financial planners 24/7 over the phone, almost as if talking to a family member. The premium account also comes with a minimum of $100k and a 0.40% account management fee.

Pros:

- Betterment uses a goal-based saving in which it asks the user to input their age, and current annual income. Using this, it suggests various goals based on the replies; hence, estimating retirement saving and general investing goals.

- Betterment is best for setting up a retirement plan as it lets you link your other non-Betterment accounts and 401(k)s allowing you a better picture of all your savings and investment accounts.

Cons:

- Betterment, unlike its competitor Wealthfront, does not have direct indexing.

More – 9 Best and Must Have iOS Apps for Business.

4. Fidelity

Fidelity is one of the few brokers that are able to serve both active traders and retirement investors. The company brings it to every level, starting with a mutual fund selection that stacks up to any other broker and even includes free benefactions. Fidelity also offers features that are important to stock traders, including strong trading platforms, no trade commissions, and a wide range of research offerings.

Pros:

- Cash, which is not invested, is automatically swept into a money market fund and then pulled out whenever never needed for trading. Most brokers need to manually invest in the money market fund.

- Flexible and customizable news feed can be sorted by watch list or holdings and updates in real-time.

Cons:

- Fidelity cannot be used globally as this investment app can only be used by US citizens, which is a major drawback.

- Customers are sometimes forced to use other platforms as well because it does not provide preferred tools.

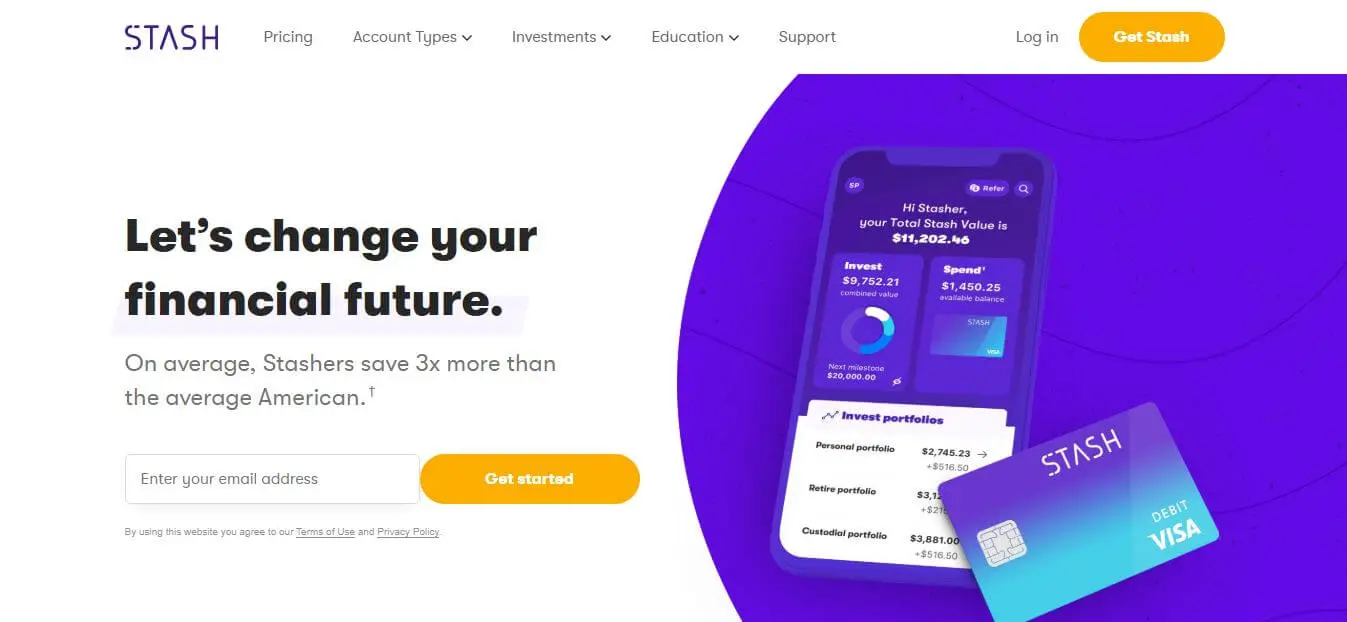

5. Stash

Stash aims to help new investors to get started with low and limited resources. The idea of building a portfolio seems overwhelming at first to new investors, but Stash makes it simpler for the investor. After you sign up in Stash, you’ll be able to build a portfolio based on your personal goals and the risks you can tolerate.

Pros:

- Low minimum investment. It only takes 1cent to start your portfolio.

- The app has a built-in guidance system that helps new investors to invest and build an investment portfolio

Cons:

- The monthly cost can be a little expensive if the investor has a relatively low account balance

- The ETFs offered through Stash are relatively diverse. However, they also have a high expense ratio that could cut into your long-term returns.

6. Round

If you bear high-end investment management in your mind, Round is the right app for it. Nowadays, investment apps are progressively approaching chatbots. The institutional managers at Round slant steadily on different strategies & benefits, together with merger arbitrage, asset-backed securities & real estate. The monthly fee is relinquished by Round in the case of negative returns.

Pros:

- Diligently Portfolio Management: One of the main reasons Round is considered one of the best investment apps.

- Ruthless Pricing: Since the market is very competitive, at 0.5%, you reimburse less than many different investment options, which include nearly all human, financial advisors.

- Distinctive & Diverse Portfolios: money market funds, mutual funds & ETFs are all incorporated within portfolios.

- Gain a Human Investment Pro: If you want to ask questions or alter your portfolio, the approach to a human is much uncomplicated.

- Pay on Profit only: For the months where your portfolio value drops, the fees are renounced.

Cons:

- An Addition on Fees: The 0.5% fee is merciless for agile investing, but inexpensive investment services & underlying funds can be found if that’s a prime concern.

- It doesn’t have an Android App.

- No Human Customer Service.

Read – 10 Best eBook Reader Apps for Android & iOS.

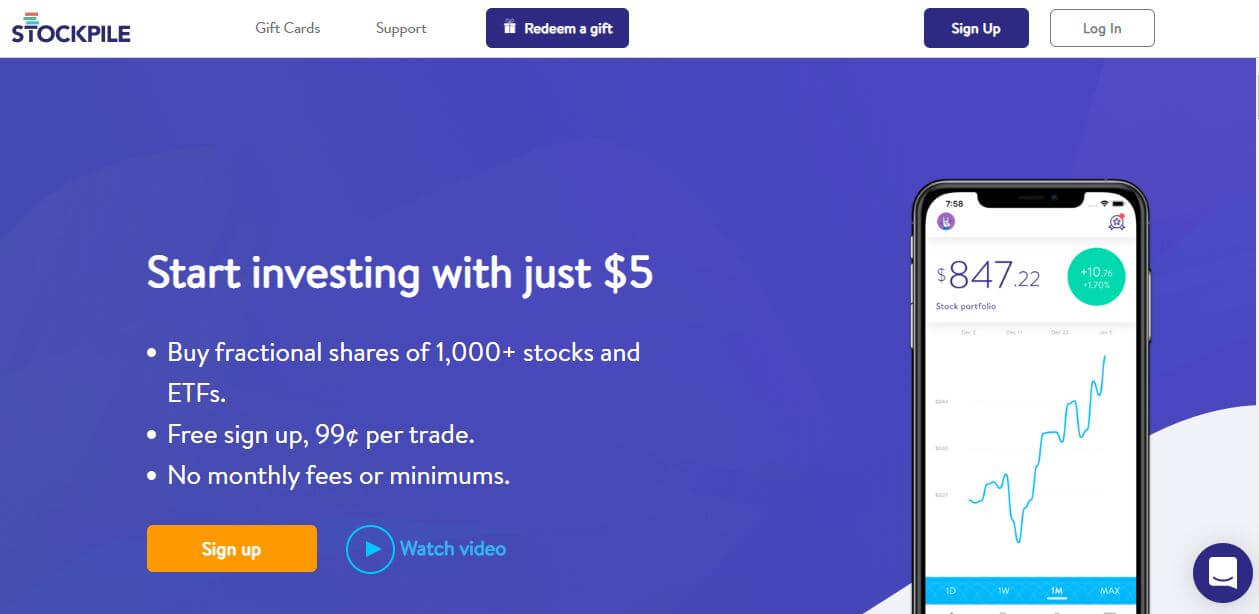

7. Stockpile

The Stockpile Stock trading app is generally known for parents and their kids. The ease of trading lets all age groups of people to understand the game of stocks and teaches everyone about wise investing.

Blue-chip stocks and ETF are the main commodities, and it operates in such a way that the initial stock will cost you 2.99 $, from there on it will cost only 0.99 $. The stocks can also be bought by the gift card, which can be purchased at the rate of 0.99 $.

Stockpile, however, does not allow us to view company portfolios or balance sheets. Hence the Stockpile can be stated as one of the best investment apps under the basic financial factors in stocks.

Pros:

- Low-priced Trading Fees: Selling & buying both costs only 99% per trade.

- Fractional Shares: By the gift cards, Stockpile consistently permits the selling& buying of fractional shares.

- No minimum account balance is needed.

- No Annual Fees.

Cons:

- Limited Account Selection: Stockpile presents only custodial & individual accounts. There are no IRAs or joint accounts.

- Restricted Investment Selection: Over a 1,000 ADRs, stocks & ETFs are available though there are many on the exchanges. No mutual funds or bonds are accessible.

- It is known as one of the best investment apps, although only for US Residents.

8. Wealthfront

They charge a management fee of 0.25% and invest in passive portfolios. The worth of tax-loss harvesting is bound for daily investors, yet holds to be popular between Robo-advisor apps. To take advantage of Wealthfront, your balance must be precise. Download it on the Apple App Store now.

Pros:

- Perks for Accounts under $5,000.

- Tax-Loss Harvesting for All Accounts.

- Stock Level Tax-Loss Harvesting.

- Risk Parity.

- 529 Plan Option.

Cons:

- No Fractional Shares.

9. TD Ameritrade

TD Ameritrade is one of the top companies that can be entrusted with your cash. Leading the bull race since 1975, TD has done a remarkable job for all entry-level investors and experienced investors. They deal with futures, stocks, bonds, cryptocurrency, and many more commodities.

Presently they hold account of 12 million clients all around the world and also assets worth 1.2 Trillion $. The company suggests their clients invest cash in money market funds, and the fund gained by doing such activity is around a billion dollars, making it one of the best investment apps.

Pros:

- No commission

- No minimum balance required

- Wide range of investments

- Good client support

Cons:

- Broker assistance can be costly

- App updates are not perfect

10. Merrill Edge

If you are a Bank of America customer, then this definitely is one of the best investment apps that you’re looking for. Merrill Edge, also knows as Merrill, has been in the investment market since 1914, with Bank of America being its parent organization.

Robust research has always been the highlight of Merrill Edge investments. They deal with mutual funds, bonds, ETF, and Options trade. The options trade carries a 0.65 $ as pre-contract fee which is very competitive among other stock brokers

Pros

- Integrated Desktop view on the app

- Robust research

- Parenting of Bank of America

- No annual fees

Cons

- Fewer securities to offer

- Mostly useful for High balance customers

- Recent updates of the app have some glitch.

Also – 10 Best Apps to Hide Photos and Videos on Android.

Bonus – Webull

Webull is newer among the vintage brokerage firms, having to be founded in the year 2017 with state of the art app development making its users have an experience where there is no space of confusion among the commodities. That’s the key reason for Webull to get listed in one of the best investment apps.

They deal with cryptocurrencies, options, ETF, stocks, etc. Every customer who wishes to open an account in the Webull acquires a free stock between 2.5$ to 250 $.

Also, referring another member to the family could also bring you free earrings and rewards. It’s considered to be the most used among the beginners and Webull has managed to keep up its good name for quite some time.

Pros:

- Charting features

- Robust app design

- Virtual money trading

- Fast account opening

- Free stocks and referral rewards

Cons:

- Investment types are limited

- Poor customer support

Best Investment Apps in India

1. Kite

This is a Mobile Trading-free App offered by Zerodha that allows customers to trade in BSE, NSE, and MCX. Kite Mobile App is the most advanced and best investment app available in India. This app is offered by Zerodha and its cutting edge technology developed by its inhouse engineers makes it the top trading platform in India. One can expect new and improved features offered on the go.

Special features

- Biometric access.

- Can trade conveniently with a super lit backend in dark mode.

- Embedded console reports to help you know the expert views enabling customers to strategize their trades.

What’s good about the app

- Biometric access.

- Seamless login into other Zerodha apps

Needs improvement

- The low rating of the app on Play Store & Apple

- Inadequate customer service

2. 5paisa Mobile App

The 5paisa mobile free trading app enables the customer to trade or invest in BSE/NSE and Robo Advisory on the go. With over a million downloads on Google Play store itself, this app has got a good rating on Play Store and the Apple App Store. The simple intuitive app’s key feature includes trading in various segments at BSE/NSE, investment in Mutual Funds, managing the accounts, and trading the market with live data. Customers can access 5 Paisa research and advisory products like Smart Investor, Sensibull, and Small cases.

Some of the transactions that can be done with the app are –

- Stock and Currency trading

- Mutual Fund investment

- Take an insurance policy

- Robo Advisory- An automated investor advisory system.

- Manage a Demat Account and Trading Account

- Real-time, streaming quotes for all segments

- Advanced charting tools

- Simple and easy to use user interface suitable for both seasonal investors and traders.

What’s good about the app

- Over a 100+ predefined stock screeners

- Access to advisory products

- The convenience of not just trading, but investing in Mutual Funds, gold, insurance, and personal loan

Needs improvement

- Consumes 176.9 MB storage space for iPhones

- Poor customer service

This app has caught on well among the traders that at the start of 2020, 5Paisa has recorded 70% of is business from the mobile app.

Also check – 10 Best eBook Alternatives for Bookzz | Read eBooks for Free.

3. Upstox

Now, UpStox Pro enables customers to trade in shares, equity derivatives, and currency Futures and Options. Upstox Pro turns out to be one of the best investment app providing features like advanced charts of multiple intervals, types, and drawing styles where one can apply over 100+ technical indicators in real-time.

The additional feature of directly trading from charts using “Trade from charts” (TFC) facility. Additionally, one can access a predefined watchlist or create a customized watchlist based on their investment strategy. The app provides real-time market feeds, and one can set an unlimited number of price alerts.

What’s good about the app

- The app has a clean, clutter-free, and intuitive look.

- Trade from charts facility

- Can set unlimited price alerts & customized watchlist

- Improved visibility as you can switch between day and night modes

Needs improvement

- Limited compatibility with iOS 11 and above

4. HDFC Securities Mobile Trading

HDFC Securities Mobile trading app comes with a secured biometric login using both fingerprint and face recognition. Customers can trade in equities and derivatives on the app and also invest in gold and NCDs.

Customers have the option to place buy and sell orders from the watchlist itself. The app offers intraday real-time charting and instant access to trending investment ideas. The customer support is good, and the app also has an embedded chat with support team functions for resolving issues quickly.

What’s good about the app

- Provision of secured Biometric login

- The ability for customers to invest in gold and NCDs

- Access to trending investment ideas

Needs improvement

- Negative reviews on login issues

- Viewing details on the white interface is difficult.

5. Angel Broking

Angel Broking App offers anywhere trading to customers in all segments. Customers have the option to trade in Equity, Derivatives, Currency, and Commodities at BSE, NSE, MCX, and NCDEX. Angel Broking also offers Investment in IPO and Mutual Funds. The below features make it one of the best investment apps one can opt for.

Features

- Secure, fast, and simple app convenient for both seasonal investors as we as frequent traders.

- Real-time streaming of quotes & charts,

- Access to multiple watchlists and research reports.

- Online fund transfer, Demat holdings, margin statements.

What’s good about the app

- Integration with the Angel’s ARQ tool for improved portfolio performance

- Intuitive design and a clean interface

- Access to the last ten transactions for Ledger, Funds, and DP reports

Needs improvement

- Only 40 Indicators and limited overlays

- Cannot invest in IPO, and bonds

Summing Up

These apps aim to try and make investing more reachable to the public. Investment apps let both knowledgeable & new investors run their investments in the financial & stock markets. These are the best investment apps for beginners. A well-grounded finance app can track spending, control routine financial tasks, shuffle money into investment accounts, and more.